am i taxed on stock dividends

How Are Dividends Taxed. Dividend yield is a common starting point for evaluating a companys dividends.

How To Report Stocks And Investments On Your Tax Return Taxact

In order to collect dividends on a stock you simply need to own shares in the company through a brokerage account or a retirement plan such as.

. Shares closed on Monday at 15173 a gain of almost. Or qualifying foreign companies whose stock youve held for at least 61 days of a 121-day holding period. Taxation of stocks can be a complex tax item for a company and its stockholders.

Back to AM Overview. The current rates range from 10 to 37. Visit The Official Edward Jones Site.

5 hours agoChevron stock comes with a 395 dividend and Credit Suisse has a 202 target price. Specifically you must record 488851 or more in taxable income as of the 2019 tax. When a shareholder receives a dividend they must include it in their tax return.

The top 20 bracket on qualified dividends is only shouldered by the extremely well-off. New Look At Your Financial Strategy. The consensus target is 18076.

Some dividends known as qualified dividends get special tax treatment. The best way to avoid taxes on dividends is to put dividend-earning stocks in a pre-tax retirement account. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

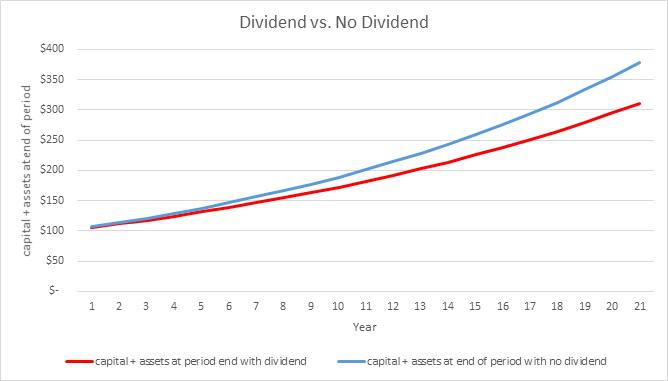

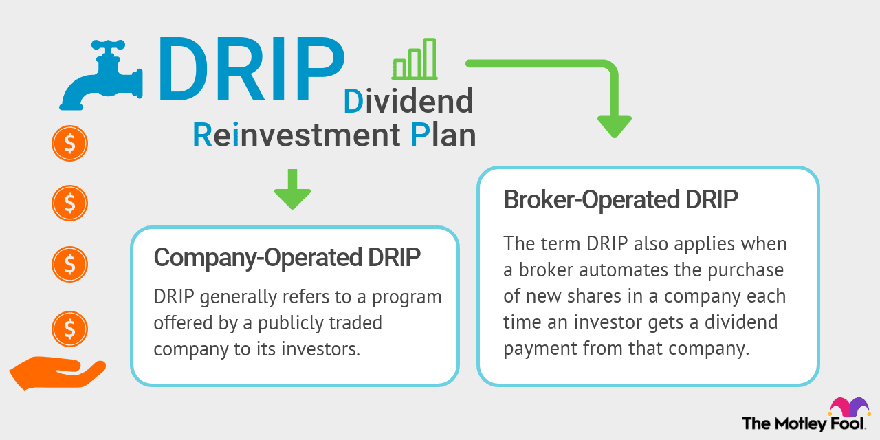

Even if you reinvest all of your dividends directly back into. How dividend stocks work. Usually thats just 15 percent though some taxpayers.

This article addresses some of the key points and considerations on taxation of stock. Yes the IRS considers dividends to be income so you usually need to pay taxes on them. Unqualified dividends are taxed at the short-term capital gains tax rate which is the same as the tax rate on regular income.

You pay tax on those at your capital gains rate. The tax component of qualified dividends is taxed at 150198. Nyse Nasdaq Amex Otcbb Dividend Tracker.

Ad Ex-Dividend Dates Dividend Calendar All-Star Rankings Special Divs More. Qualified dividends come from investments in US. Generally any dividend that is paid out from a common or preferred stock is an ordinary dividend unless otherwise stated.

This is a stocks annual dividend payments expressed as a percentage of the stocks current. Ordinary dividends are taxed as ordinary income. As an example I currently have 112 shares.

Dividends are federal and provincial taxes.

How Are Dividends Taxed In Canada Exploring The Canadian Dividend Tax Credit

Dividend Reinvestment Should I Do It The Motley Fool

Don T Forget Taxes When Comparing Dividend Yields Cfa Institute Enterprising Investor

Tax On Dividend Income Taxation On Dividend Income In India Ddt Indmoney

How Are Stock Dividends Taxed Howstuffworks

Stock Dividends How They Work What They Are Seeking Alpha

Stock Dividends Vs Cash Dividends Definition Differences

The Basic Deemed Dividend Tax Rules Toronto Tax Lawyer

Taxation Of Dividend Income And Capital Gains

Pdf Impact Of Dividend Policy Earning Per Share Return On Equity Profit After Tax On Stock Prices

Shareholders Should Pay Tax On Dividend Not The Company Suggests It Task Force Diu News

Uk Dividend Tax Rates And Thresholds 2022 23 Freeagent

Double Taxation Of Corporate Income In The United States And The Oecd

Dividend Income Taxable From Fy21 How Much Tax Do You Have To Pay Youtube

:max_bytes(150000):strip_icc():gifv()/Term-Definitions_stockdividend_FINAL-879dca8a58b044d5b3ab0047bec962d3.png)

:max_bytes(150000):strip_icc()/shutterstock_342649796-5bfc3d8846e0fb00511e30c8.jpg)